What is an Equity Fund?

An Equity Fund is a mutual fund that invests primarily in stocks or equity-related instruments. These funds are designed to generate long-term capital appreciation.

They suit investors looking for high growth potential while comfortable with market fluctuations.

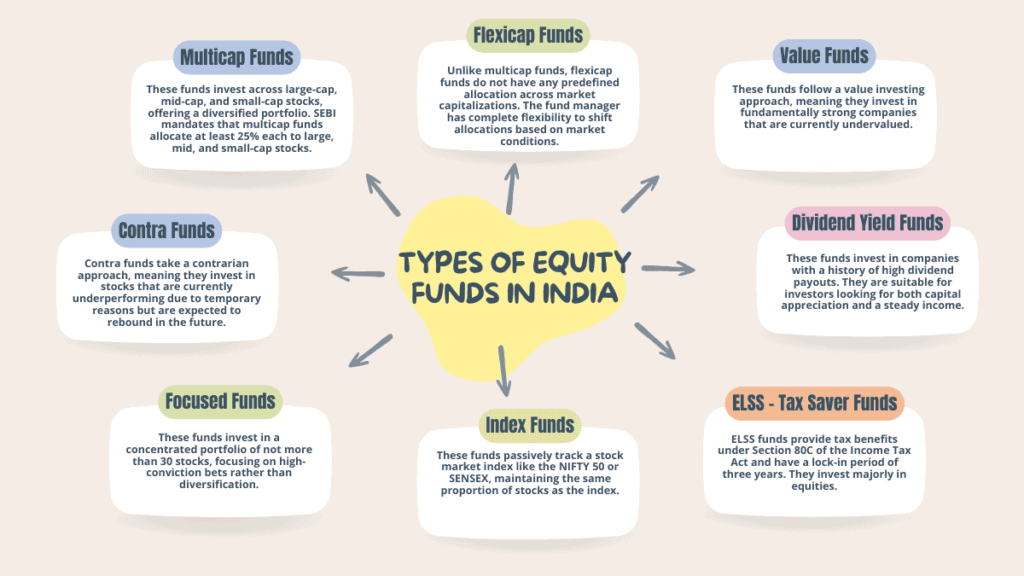

Equity funds are categorized based on market capitalization (large-cap, mid-cap, small-cap), investment strategy (growth, value, dividend yield), and sectoral/thematic focus (IT, pharma, banking, infrastructure, etc.).

How Equity Funds Work in India?

Equity mutual funds pool money from investors and allocate it across various stocks based on the fund’s investment objective. These funds are managed by professional fund managers who analyze market trends, company fundamentals, and economic factors to optimize returns.

Since stock markets can be volatile, equity funds tend to perform well over the long term (5-10 years or more), making them ideal for wealth creation.

Key Takeaways

- Equity funds offer high return potential but come with volatility.

- Long-term investment (5-10 years) reduces market risk and enhances returns.

- SIPs help in disciplined investing and mitigate market timing risks.

- Investors should choose funds based on their risk appetite and financial goals.

Equity funds are excellent for Indian investors aiming for wealth creation and long-term financial stability.

Conclusion

Equity funds offer a range of investment strategies to suit different risk appetites and financial goals.

Whether you’re looking for diversification (Multicap, Flexicap), value investing (Value, Contra), steady income (Dividend Yield), tax benefits (ELSS), passive investing (Index Funds), or high-conviction bets (Focused Funds), there’s an option for every investor.

Before investing, assess your risk tolerance, financial goals, and investment horizon to choose the right type of equity fund. Happy investing!

Disclaimer

SIPinsight.com is for informational and educational purposes only. We do not provide investment advice, stock tips, or financial recommendations. Mutual fund investments are subject to market risks; please read all scheme-related documents carefully before investing. Past performance is not indicative of future returns.

We are not SEBI-registered advisors. Investors should consult a qualified financial advisor before making investment decisions. SIPinsight.com does not guarantee any information provided’s accuracy, completeness, or reliability.

Using this website, you agree that SIPinsight.com shall not be held responsible for any financial losses incurred based on the information available here.